Yet another crazy week for financial markets, showing that they continue to be broken by central bank’s interventions.

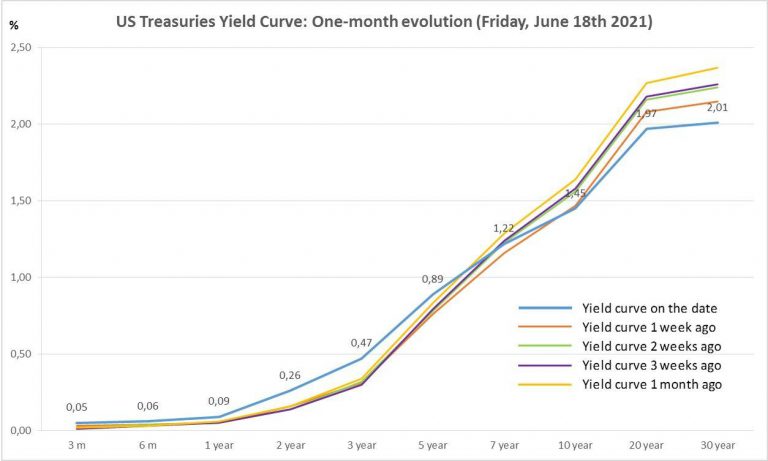

This week we knew the Federal Reserve will finally start considering rate hikes and reducing asset purchases (tapering). This sent the gold price almost 6% down (worst week since the 2020 Covid outbreak). However, the US 10-year yield once again fell below the 1.50% level and the long-end of the curve dropped as well.

Fair enough! We don’t know when the Fed will hike interest rates. We don’t even know whether it will be able to do so. And the same can be said about tapering. However, long-term rates fall, and “obviously” the price of gold collapses in an environment of booming inflation… Really??

Financial markets are clearly malfunctioning and fundamentals continue to be totally ignored because investors only pay attention to the delusional forecasts of central banks.